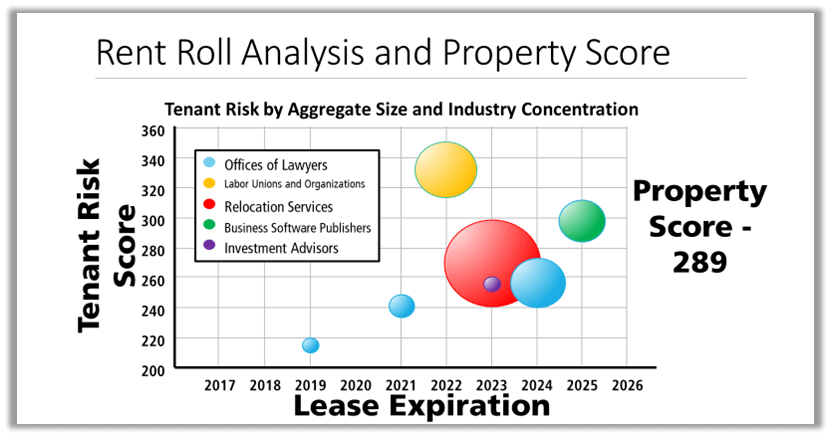

Megalytics takes your property rent roll and automatically determines inherent risks not readily obvious in the tenant mix. Does the Tenant mix and rents meet your vision for the property?

Megalytics can provide:

- Proprietary scoring using algorithms to evaluate each tenant’s likelihood of meeting their rent payments.

- Identify concentration of tenants in high risk industries and/or compatible tenants for a retail site.

- Help you to improve your tenant mix as leases expire.

This is an essential tool that will help you in your decision-making process for acquisitions and for dispositions of properties or portfolios.

Higher Risk Tenants

Using proprietary scoring algorithms we evaluate each tenant’s likelihood to make their rent payments

Higher Risk Industries

Identify concentration of tenants in high risk industries

Proactive Rent Roll Management

Improve your tenant mix as leases expire.

Rent Roll Analyzer and Score

Megalytics takes a building rent roll and

automatically determines the risk inherent

in the tenant mix.

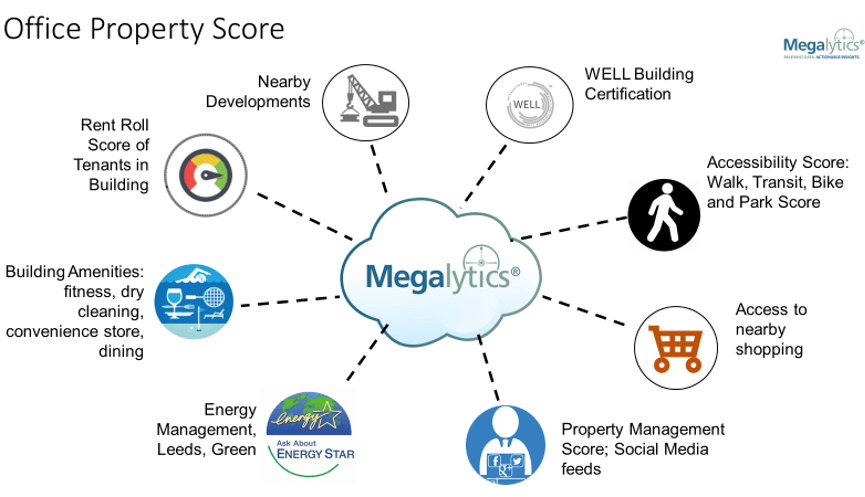

The Megalytics Office Building Score can be an

integral part of evaluating a building for

acquisition or disposition. It is an ideal

component for portfolio analysis.

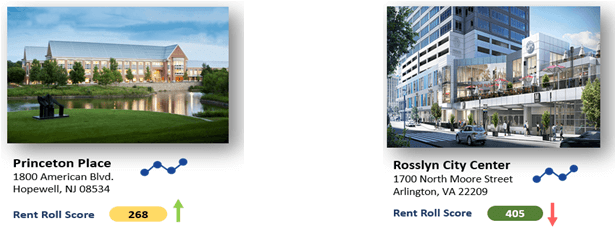

The Rent Roll Score for each property is shown in the dashboard along with a trend line on how the tenants are doing. Several tenants were severely impacted by COVID in Princeton Place, but now are improving. Rosslyn City did well during COVID, but now a few tenants are struggling.

OUR PROCESS

The following steps are taken for Rent Roll Analysis.

Low-sustainability, high-risk tenants based on proprietary scoring algorithms and analytics

Each tenant will be scored based on proprietary scoring algorithms and analytics.

Determine concentrations of tenants in high risk industries.

Proactively managing your rent roll by replacing higher risk tenants and industries as their leases expire.

This is a product that allows you to have comfort in the stability of your cash flow. I haven’t seen anything like the lieve of detail Megalytics provides. The level of granularity is unmatched.

What our clients say…

Megalytics is distinguished by its capacity to access diverse/multifaceted data and information. Beyond employing a fulsome collection of data sources, Megalytics is on the cutting edge of new tech-sourced place positioning and spatial interaction patterns that provide unprecedented, previously inaccessible insights. Further, Megalytics supplements assessments based on hard and novel numbers analytics with mystery shopping and tenant surveys that reveal illuminatingly nuanced, surprising, and sometimes shocking perspectives in support of more informed, confident decisions. In a world in which uncertainties are evermore pervasive, Megalytics can be the secret weapon to reduce the ‘un’ and increase the probability of being right.

Stephen Roulac, PhD

Roulac Global

“We needed a quick, yet comprehensive, analysis of industrial tenants at 35 properties as part of a recent $2 billion industrial portfolio acquisition and Megalytics delivered for us so we could move forward with confidence yet drill down on the tenants and properties that needed further review. We use Megalytics for both our equity and debt investment programs. We are very pleased with Megalytics.”

Steven McCarthy

Head of North America, Real Assets, AXA Investment Managers US, Inc

Megalytics has been our go-to provider when vetting prospective tenants for our office portfolio. The team is responsive, consistent and reliable. What sets Megalytics apart is their customer service and depth of knowledge– they establish a strong client relationship and are well equipped to answer any questions that you may have about an assessment.

Mary-Kate Michalak

Manager, Corporate Leasing & Strategy, Strategic Property Partners, LLC

Stay In Touch